“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.”

– quote attributed to Abraham Lincoln

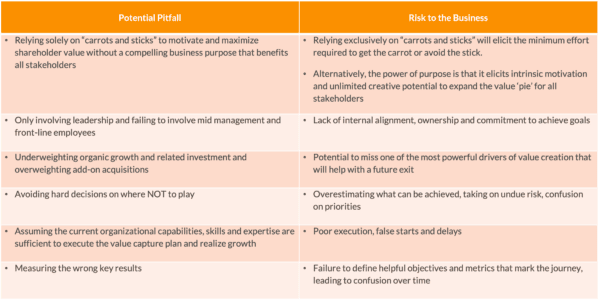

Private equity sponsors and their portfolio companies typically undertake value capture planning after a deal close to guide the business’s value creation efforts over the ensuing ~5-year investment holding period. Unfortunately, many attempts result in pitfalls that undermine value creation and pose significant risks (see table below). Business takeovers by private equity and value capture planning efforts can be perceived as nothing but a means to make private equity investors more money resulting in employee disengagement and lack of commitment. Private equity’s need to generate shareholder returns quickly can lead to shortcuts that further compound these issues, resulting in frustration, talent flight and poor execution.

There’s a better way. Taking a purpose-driven approach to value capture planning can help avoid these pitfalls and maximize value creation. It reflects a ‘go slow to go fast’ process – a disciplined approach to laying a strong foundation and fact-based, comprehensive, and purpose-driven planning to cultivate stakeholder engagement.

Pitfalls to Avoid

There are many potential pitfalls during the value capture planning process. We call out a few of the most pervasive we’ve seen private equity owned portfolio companies encounter.

A Purpose-driven Planning Approach

We recommend a holistic approach to value capture planning that embeds motivating corporate purpose, vision and values at the outset to cultivate stakeholder engagement (see graphic below). It calls for the team to “go slow” to explore new, innovative ideas to achieve the vision and to dig in to really understand the opportunity and what it will take to win. Getting this right is critical to delivering the returns expected by PE sponsors.

During Phase 1, Purpose, Vision, Values, it is critical to align on a motivating corporate purpose, vision and values as this becomes the beating heart that powers the team. This also creates space for leadership to step back, remove old constraints and establish the art of the possible with private equity backing. From this foundation, the team can open the aperture regarding potential growth and profit improvement opportunities during the ~3-5 year planning horizon.

It is equally critical to assemble the right team and gather the right set of perspectives. We recommend assembling the full, cross-functional executive team supported by external resources to facilitate the process, support research efforts, keep the team on track, challenge the thinking and help pull it all together. Perspectives should be solicited from multiple stakeholder groups including leadership, middle management, front-line employees, key customers and suppliers on the company’s core capabilities, purpose and most promising opportunities (e.g., core business penetration, new markets/offerings, innovation/differentiated offerings, operational improvements).

With purpose and vision newly clarified, the team can explore innovative ideas and revisit previously identified opportunities during Phase 2, Business Case Development, that the company can now pursue with PE backing. This is the stage where the team needs to dig in and do the work to really understand the identified opportunities and what it will take to win. Internal working teams are critical to getting this right. They also provide valuable opportunities to bring people into the process, give rising leaders opportunities to shine as well as tap into the knowledge of internal subject matter experts. Opportunities that do not make the cut at the end of this phase should be documented and revisited during subsequent annual planning efforts.

During Phase 3, Value Capture Playbook, the team develops the Value Capture Playbook. The Playbook includes the board-level strategy articulation to clearly describe the company’s purpose, vision, values and strategy to the board and internal stakeholders as well as an integrated action plan to guide execution of prioritized opportunities. This phase marks the end of debates and analysis and focuses on getting the organization prepared to execute. This includes identifying the right set of initiatives and who will own them. Key initiatives should reflect prioritized growth and profit improvement opportunities as well as how the company will live its stated values. For example, some private equity firms, including KKR and Blackstone, have prioritized employee engagement including broadening ownership within portfolio companies with positive results.

At this point, it is also important for private equity sponsors and management to align on investments and expectations for year one and beyond. This represents a shift in decision making for management teams new to PE and both sides need to take the time to get aligned. As a result of these efforts, the organization’s playbook development capability is strengthened, and the playbook can be refreshed over time.

Finally, Phase 4, Execute is focused on high-quality execution. This includes communicating progress regularly, getting ahead of issues and resolving them quickly to keep execution on track. A PMO provides enhanced visibility and avoids kicking problems down the road. No plan is perfect but good execution requires tracking, problem solving and organizational tenacity to keep moving forward.

Conclusion

While private equity sponsors and their portfolio companies typically use value capture planning to steer organizational focus, too many encounter pitfalls that risk organizational dysfunction and underperformance. A purpose-driven approach is needed to maximize value creation while avoiding pitfalls. As a result, the organization is aligned, intrinsic motivation and creativity to achieve higher purpose is harnessed, execution efforts are streamlined, and the business’s true potential can be realized.

__________________________________________________________________________

Jennifer Parkes Kozak is a Managing Director with Groove Strategy Group LLC. She has over 18 years of experience helping B2B companies accelerate profitable growth via strategic growth planning, commercial excellence, go-to-market transformation, market / opportunity assessment and entry planning. She can be reached at jkozak@groovesg.com.

Michael Connerty is the Founder and Managing Partner of Groove Strategy Group LLC. He has over 28 years of experience and can be reached at mconnerty@groovesg.com.